HOMER Grid 1.10

![]()

Capital based incentives apply to the capital cost of the components. This could either be a tax deduction or a credit or both.

In HOMER Grid, you can apply a capital based incentive to the following components:

•Solar

•Storage

Below is an explanation of the various inputs in capital based incentive

Variable |

Description |

Percent deduction (%) |

Tax deduction as a percent of the capital cost |

Maximum deduction |

Maximum deduction limit |

Percent credit (%) |

Tax credit as a percent of the capital cost |

Credit per kW (per kWh for storage) |

Additional credit per kW/kWh of installed capacity |

Maximum credit |

Maximum credit allowed |

Eligible percent (%) |

Portion of capital cost eligible for incentive |

Marginal tax percent (%) |

The percent of tax applicable |

Credit is taxable |

Select this option if the credit is reduced by the marginal tax rate |

Reduces tax basis |

Select this option if deduction and credit reduces the tax basis (cost basis) |

Applies to |

The components that this bonus depreciation applies to |

Below are two examples of capital based incentives:

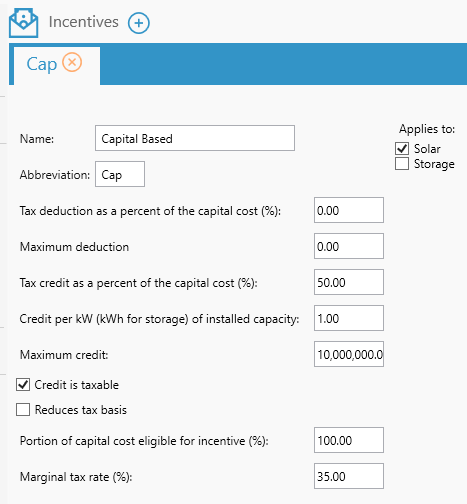

Example 1

Let us consider a PV system of 100 kW which has a total capital cost of 100,000$. If the capital based incentive applied to this PV system is:

This would mean that the tax credit applied to the system is = 50% of capital cost = 0.50 * 100,000$ = 50,000$

Additional credit per kW of installed capacity = 1 $ * 100 kW (installed capacity) = 100 $

Total credit = 50,000$ + 100$ = 50,100$

Since the "Credit is taxable" is selected, the marginal tax rate is applied to this credit = (1 - 0.35) * 50,100 $ = 32,565 $

Total Capital based incentive = 32,565 $

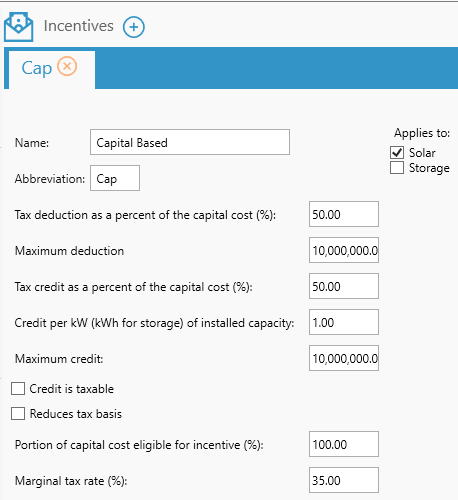

Example 2:

Let us consider a PV system of 100 kW which has a total capital cost of 100,000$. If the capital based incentive applied to this PV system is:

This would mean that the tax credit applied to the system is = 50% of capital cost = 0.50 * 100,000$ = 50,000$

Additional credit per kW of installed capacity = 1 $ * 100 kW (installed capacity) = 100 $

Total credit = 50,000$ + 100$ = 50,100$

Since the Tax deduction is 50 % of capital cost = 0.50 * marginal tax rate * capital cost = 0.50 * 0.35 * 100,000$ = 17,500$

Total deduction and credit = 17,500 + 50,100 $ = 67,600 $