HOMER Grid 1.10

![]()

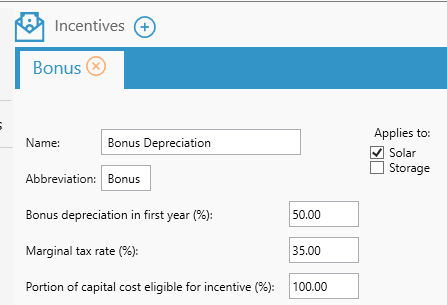

Bonus depreciation, is in addition to the normal depreciation that allows businesses to reduce the cost of purchases.According to the Internal Revenue Service (IRS), "bonus depreciation allows taxpayers to deduct a specified percentage (30, 50, or 100 percent) of depreciation in the year the qualifying property is placed in service". There are specific eligibility criteria that the purchased assets have to meet to be eligible for the bonus depreciation.

In HOMER Grid, you can apply a bonus depreciation to the following components:

•Solar

•Storage

Below is an explanation of the various inputs in Bonus Depreciation

Variable |

Description |

Percent Credit |

The percentage of bonus depreciation applicable in the first year |

Marginal tax percent |

The percentage of tax rate on the purchased asset |

Eligible percent |

Percentage of the capital cost eligible for the incentive |

Applies to |

The components that this bonus depreciation applies to |

Example

Let us consider a PV system of 100 kW which has a total capital cost of 100,000$. If the bonus depreciation applied to this PV system is as shown below:

This Bonus depreciation = 0.50 * 0.35 * 1 * 100,000$ = 17,500 $