HOMER Grid 1.10

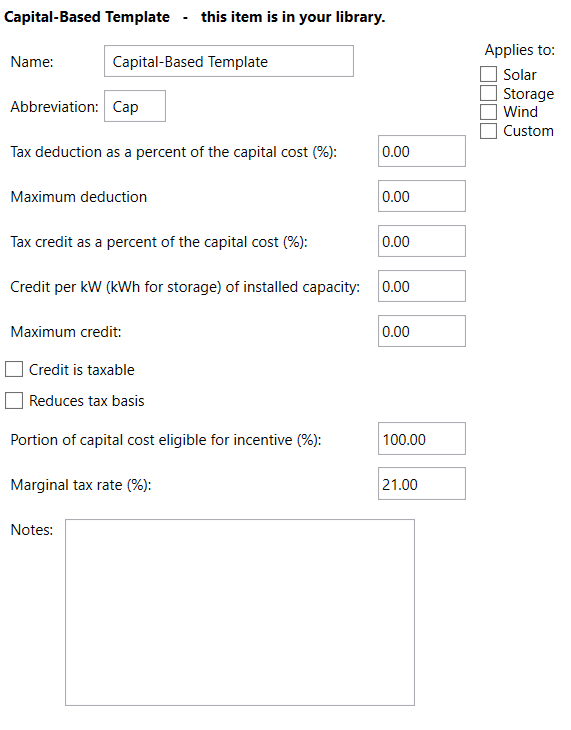

Capital based incentives apply to the capital cost of the components. This could either be a tax deduction or a credit or both. In HOMER Grid, you can apply a capital based incentive to the following components: solar, storage, and wind.

Below is an explanation of the various inputs in a capital-based incentive template:

Variable |

Description |

Percent deduction (%) |

Tax deduction as a percent of the capital cost |

Maximum deduction |

Maximum deduction limit |

Percent credit (%) |

Tax credit as a percent of the capital cost |

Credit per kW (per kWh for storage) |

Additional credit per kW (or kWh) of installed capacity |

Maximum credit |

Maximum credit allowed |

Eligible percent (%) |

Portion of capital cost eligible for incentive |

Marginal tax percent (%) |

The percent of tax applicable |

Credit is taxable |

Select this option if the credit is reduced by the marginal tax rate |

Reduces tax basis |

Select this option if deduction and credit reduces the tax basis (cost basis) |

Applies to |

The components that this incentive applies to |

See also