HOMER Pro 3.16

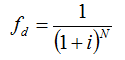

The discount factor is a ratio used to calculate the present value of a cash flow that occurs in any year of the project lifetime. HOMER calculates the discount factor using the following equation:

where: |

|

|

|

i |

= real discount rate [%] |

|

N |

= number of years |

Example: For i = 5% and N = 12 years, the discount factor equals 0.557. That means a $1000 nominal cash flow in year 12 has a present value of $557. In other words, a $1000 cash flow in year 12 is equivalent to a $557 cash flow in year zero. This is a demonstration of the time value of money; a dollar is now worth more than a dollar twelve years in the future.

See also